Disclaimer: This guide is not intended to provide financial advice or recommendations. Please consult a financial professional or the ATO before making any decisions to withdraw from superannuation.

At Dental Boutique, we believe that nothing should prevent you from getting the dental treatment you need.

However, unfortunately, more than 2 million Australians avoid or delay visiting the dentist every year because they simply can’t afford it.

Thankfully, there is a way that dental work can be made more affordable. When you visit Dental Boutique, you can use your superannuation to pay for your dental work. If you’re experiencing acute or chronic tooth pain, you may be eligible to access your superannuation for your dental treatment before you reach the age of retirement.

So, if you’re in need of dental treatment but lack the necessary funds, we’re here to explain exactly how you can access and use your superannuation for dental work.

How Do I Access & Use My Superannuation For The Dentist?

In Australia, every individual can apply for the government’s Early Release of Superannuation program. This program is designed to give people early access to their superannuation for dental work and other necessary services.

However, it’s important to note that you can only access your super early under very specific conditions. One of these conditions is on compassionate grounds, especially for unpaid expenses that you have no way to cover. The amount you can take out is strictly related to the actual unpaid expense.

The ATO defines Compassionate Grounds as requiring funds for:

- Medical care, medical bills, dental costs, and medical transportation for either you or a dependent (this includes major dental procedures).

- Adjustments to your home or car to cater for a severe disability for you or your dependent.

- Mortgage or council rate payments to prevent losing your home.

- Palliative care for you or a dependent.

- Costs linked with the passing, funeral, or burial of a dependent.

You’ll need to consult with a qualified dental practitioner and a dental specialist or GP to prove you’re eligible to access your superannuation for dental work. They can assist you in acquiring the documentation for the early release of your super.

This documentation includes:

- An itemised quote or unpaid invoice for the required dental treatment.

- A medical report stating the dental issues are causing you chronic or acute pain.

- A copy of your treatment plan, including all stages of the treatment.

These documents need to be signed and completed no more than six months before the dental treatment.

To access your superannuation for dental on compassionate grounds, you need to meet all eligibility criteria and provide the appropriate documents to support your application. Applications without these documents may be delayed or rejected.

You can submit your application via ATO Online, or on paper if you don’t have access to ATO’s online services.

The super you withdraw on compassionate grounds is paid and taxed as a normal super lump sum. The ATO has resources on how tax applies to your super withdrawals and a super lump sum tax table for more information.

Am I Eligible?

To determine if you’re eligible for compassionate release of your super, you’ll need to meet all of the following:

- Condition 1

You are or were an Australian or New Zealand citizen or permanent resident.

You’re not eligible to apply if you’re a temporary resident.

If you were a temporary resident and aren’t a current Australian or New Zealand citizen or permanent resident, you’re not eligible to apply. However, you may be eligible to access your super for dental with a Departing Australia superannuation payment.

- Condition 2

You meet the requirements for the specific compassionate ground you’re applying for. For dental work, this falls under “Medical (treatment or transport)”.

Medically essential criteria:

Criteria A:

You or your dependent need medical treatment for a life-threatening condition, for relief from severe acute or chronic pain, or to address acute or chronic mental distress.

Criteria B:

The necessary medical treatment for you or your dependent isn’t free via the public healthcare system.

- Condition 3

You haven’t already paid the expense. Compassionate releases are only available on unpaid expenses.

- Condition 4

You can’t afford part or the total expense without accessing your super. For example, you can’t pay the expense by:

- Applying for a loan

- Using your savings or a credit card

- Selling investments, shares, or assets

- Accessing other relevant funding

- Condition 5

If you’re applying on behalf of a dependent, you must provide all required supporting evidence and unpaid invoices or quotes, including any documentary evidence of your relationship.

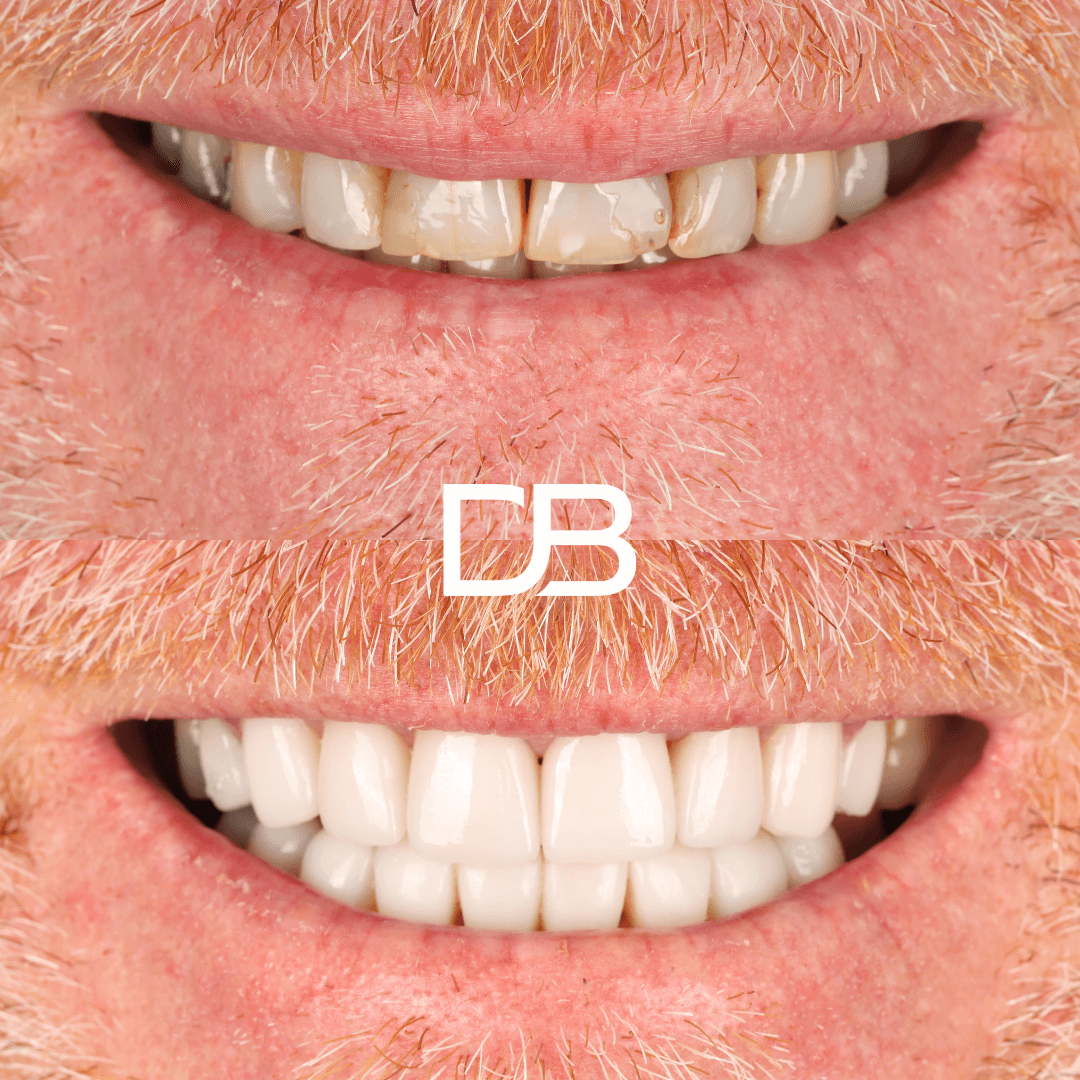

What Dental Work Can I Receive?

If you’re using your superannuation for dental work, note that only a selection of treatments are covered by compassionate grounds.

These include:

- Dental implants

- Dental crowns

- Root canal treatment

- Periodontics treatments

- Braces/orthodontic care

- O&M surgeries (oral and maxillofacial)

Accessing & Using Superannuation for Dental Care at Dental Boutique

Apply for the government’s Early Release of Superannuation program to access and use your super for your dental needs.

Remember to consult with dental professionals and gather the required documentation before submitting your application to the ATO.

If you’re ineligible for the early release of your superannuation, you have other options, such as private health insurance or Dental Boutique’s flexible payment plans.

Your smile is within reach, and we’re here to help you every step of the way.

Summary

- Australians experiencing acute or chronic dental issues may qualify for the Early Release of Superannuation program on compassionate grounds to fund necessary dental treatments.

- Applicants must meet specific criteria, including being an Australian or New Zealand citizen or permanent resident, requiring medically essential treatment and demonstrating an inability to cover expenses through other means.

- Accessing superannuation requires documentation such as itemised treatment quotes, medical reports indicating the severity of the condition and a detailed treatment plan, all verified by a dental practitioner and submitted to the ATO.

- For those ineligible for superannuation access, Dental Boutique offers flexible payment plans and partners with major private health insurance providers to make dental care more affordable.

About Dental Boutique

A Dental Boutique™ smile is carefully crafted to perfectly complement your uniqueness, all to achieve the most spectacular result. A Dental Boutique™ smile is carefully crafted to perfectly complement your uniqueness, all to achieve the most spectacular result. Find out more by contacting our team today.