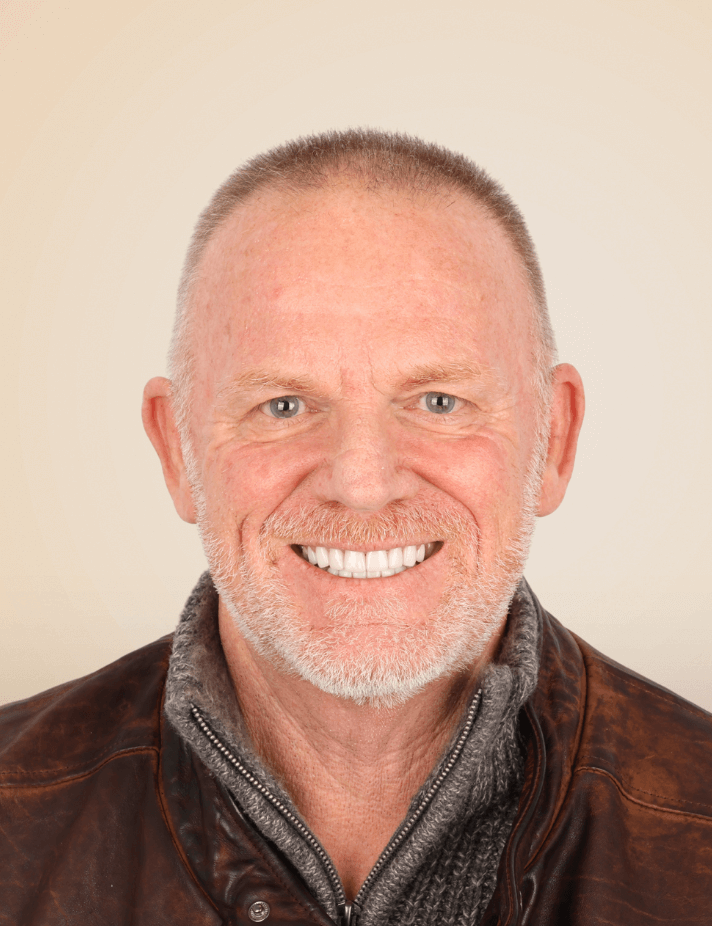

At Dental Boutique™, we are dedicated to ensuring that nothing stands between you and the empowered, healthy smile you deserve. Our commitment lies in providing accessible, high-quality services that help empower you to look and feel your best.

If you require dental treatment but lack the necessary funds, you may be eligible for a compassionate release of superannuation for dental treatment or medical transport expenses for yourself or a dependent.

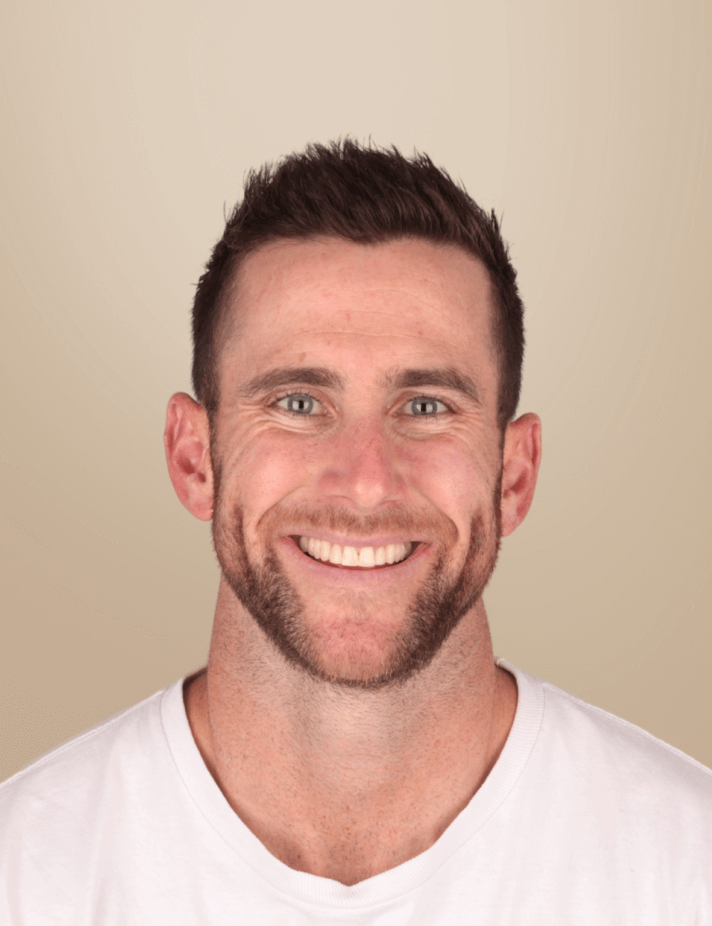

Take advantage of our complimentary 60-minute Dental Consultation to discover personalised treatment options designed specifically for you, along with a clear breakdown of the associated pricing.

Process

In Australia, individuals may apply for early access to superannuation for essential services, including dental treatment.

Early access to super is strictly regulated and only granted under specific eligibility conditions, such as compassionate grounds. This scheme is designed to assist with unpaid expenses that cannot be covered through other means, with the release amount generally limited to the actual outstanding cost.

Early access to your super on compassionate grounds is permitted only for specific expenses. You may be eligible to access your super to cover costs for: Medical care, medical bills, dental costs and medical transportation for either you or a dependent (this includes major dental procedures).

To determine if you’re eligible for compassionate release of your super, you’ll need to meet all of the below:

Eligibility Criteria

Condition 1

You are or were an Australian or New Zealand citizen or permanent resident.

If you were a temporary resident and aren’t a current Australian or New Zealand citizen or permanent resident, you’re not eligible to apply. However, you may be eligible to access your super for dental with a Departing Australia superannuation payment.

Condition 2

You meet the requirements for the specific compassionate ground you’re applying for. For dental work, this falls under medical treatment and/or medical transport expenses.

Medically essential criteria:

Criteria A:

You or your dependent need medical treatment for a life-threatening condition, for relief from severe acute or chronic pain, or to address acute or chronic mental distress.

Criteria B:

The necessary medical treatment for you or your dependent isn’t free via the public healthcare system.

Condition 3

You or your dependant’s expense is unpaid or has been paid as a result of you borrowing money that remains outstanding.

Condition 4

You can’t afford part or the total expense without accessing your super. For example, you can’t pay the expense by:

- Applying for a loan

- Using your savings or a credit card

- Selling investments, shares or assets

- Accessing other relevant funding

Condition 5

You must provide all necessary supporting evidence, including medical records, invoices or quotes, and treatment plan (if applicable). If you’re applying for superannuation release on behalf of a dependent, you must also provide any documentary evidence of your dependent relationship.

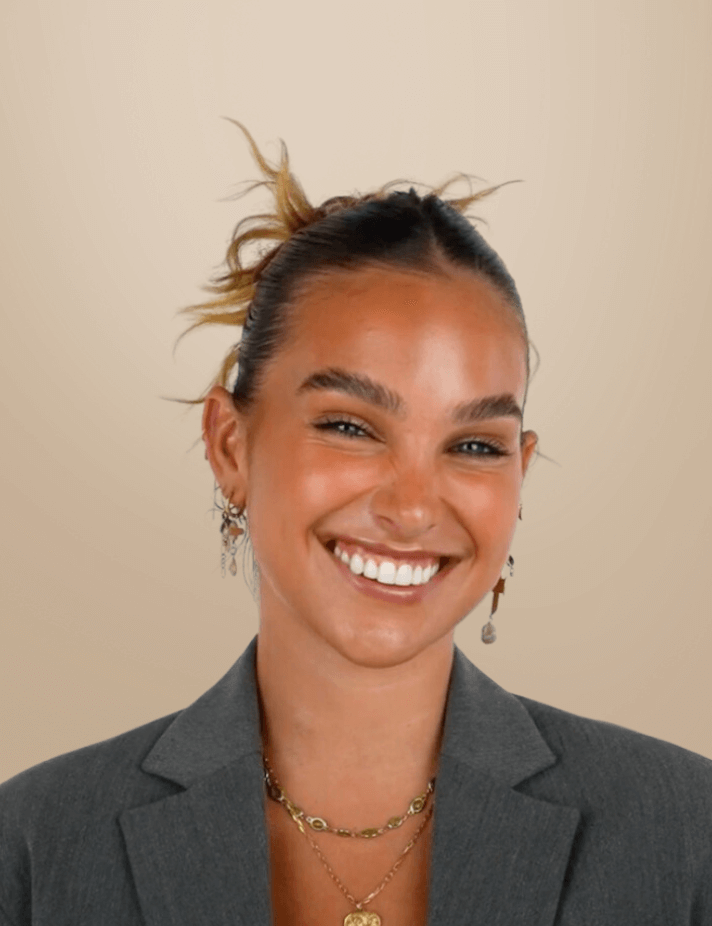

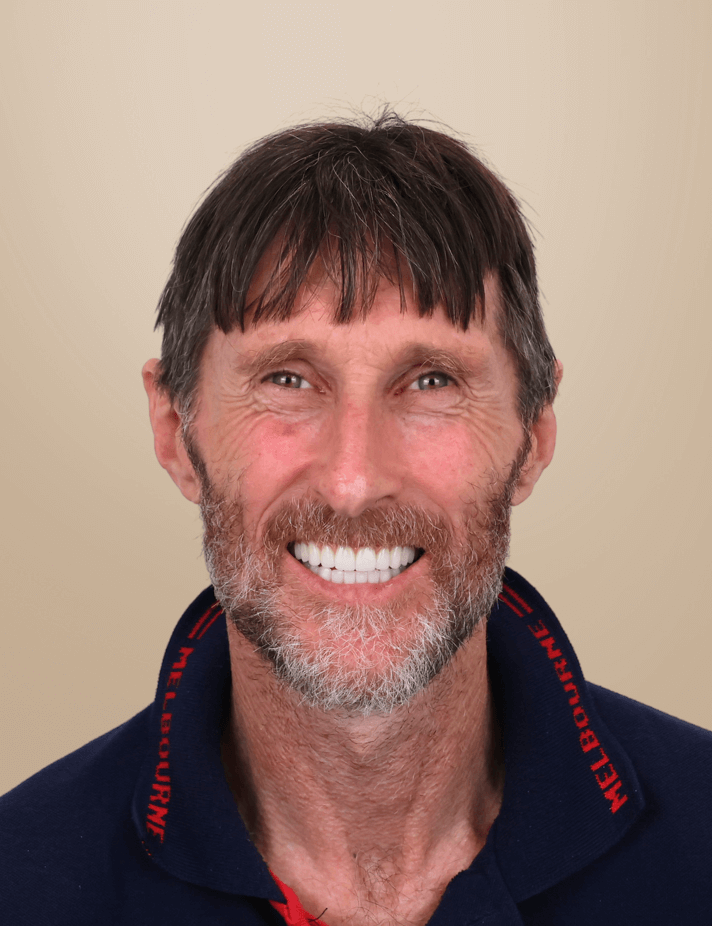

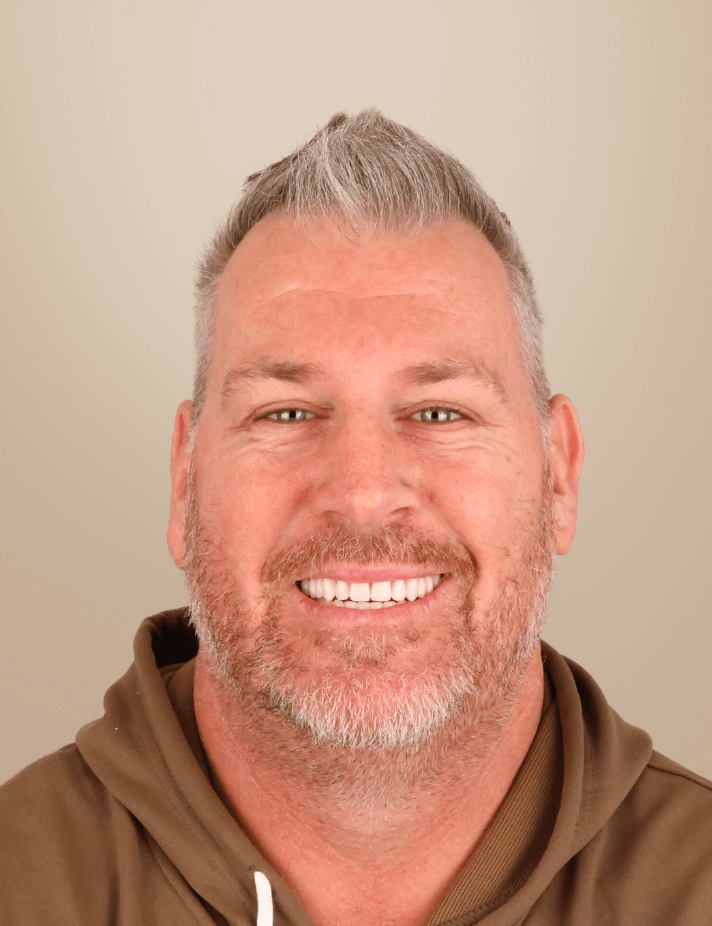

Get smiling from $53 per week

Tell us about yourself and your dental concerns, and we'll be in touch shortly.

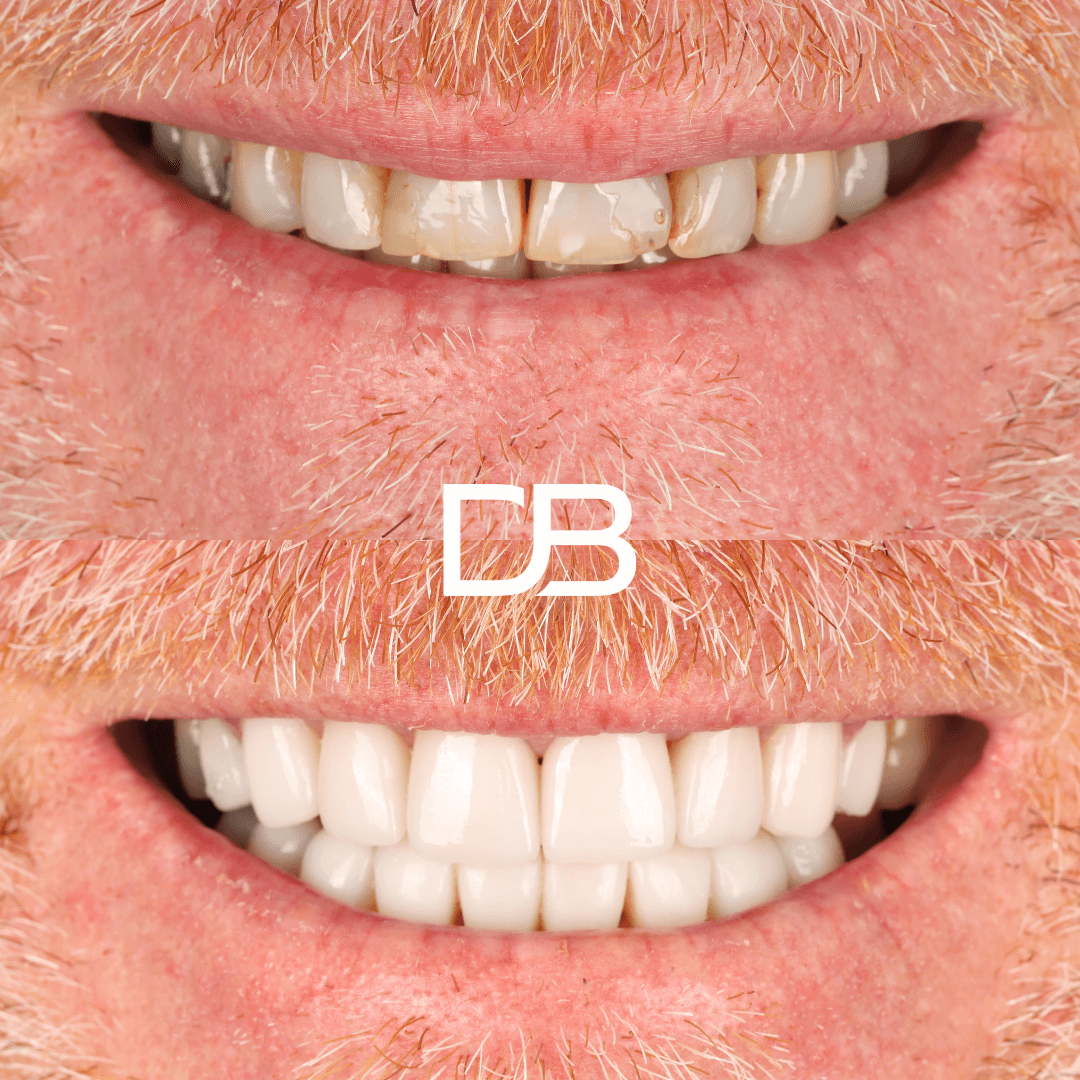

What Dental Work Can I Receive?

If you’re using your super for dental work, note that only a selection of treatments might be eligible under compassionate grounds.

These might include:

Dental implants

Dental restorations

Root canal treatments

Periodontics treatments

Braces/orthodontic care

O&M surgeries (oral and maxillofacial)

Start smiling proud today

Application process

If you’re considering using super for dental treatment, remember to:

Consult with your dentist and/ or a medical professional

You must consult a dental practitioner and either another dental practitioner or a registered medical practitioner to help you obtain the medical reports and supporting documentation required for the early release of your super.

Prepare the necessary documentation before applying to the ATO through myGov

If you are applying for dental treatment, you are required to provide the below evidence:

- A treatment plan: a copy of your treatment plan with details of all stages of the treatment

- A quote: an itemised quote or an invoice

- Two medical reports: This could either be a report from a registered medical practitioner and report from a dental practitioner or 2 medical reports from separate dental practitioners.

Financial Considerations

Before applying for early access to your superannuation, it’s important to consider the potential financial impacts:

- Income tax: Accessing your super early may affect the amount of tax you pay or other government payments you receive. Some super funds may also charge a processing fee, depending on the provider.

- Government benefits: Releasing super early may affect your future retirement income, your income protection insurance, your life and total and permanent disability insurance cover, your Family Tax Benefit or your child support payments. .

Before applying to access your superannuation, it’s important to understand your options and the potential financial implications. You may wish to seek professional financial advice before making a decision.

Alternative payment options

In addition to super, there are alternative options available, including private health insurance and Dental Boutique’s flexible payment plans. Depending on your treatment type, payment plans begin from as little as $53 per week.

Furthermore, if you have health insurance with dental coverage, the insurer may pay a certain amount towards your treatment depending on the terms of your contract with them.

Why choose Dental Boutique?

At Dental Boutique, your wellbeing is our top priority. We’re committed to helping you access the dental care you need, without unnecessary barriers.

If you are not eligible for early release of super, we’ll provide you with alternative payment options, empowering you to choose the path that works best for you.

FAQ’s

Can I use my super to pay for dental treatment?

Yes, in certain cases. You may be able to access your super early on compassionate grounds, but only for certain dental treatment that meet the eligibility conditions.

What types of dental treatments are covered under compassionate grounds?

Generally, eligible treatments are those that either treat a life-threatening illness or injury, alleviate acute or chronic pain, or alleviate acute or chronic mental illness. Additionally, the medical treatment also needs to be not readily available through the public health system.

Who decides if I'm eligible?

The Australian Taxation Office (ATO) assesses your application, but you must first obtain supporting documentation from a registered medical or dental practitioner.

What documents do I need to provide?

If you are applying for dental treatment, you’ll need:

- A detailed treatment plan with details of all stages of the treatment

- An itemised quote or an invoice

- Two medical reports (one from a dental practitioner and one from another dental practitioner or a registered medical practitioner)

Can I apply for someone else’s dental treatment (e.g. my child or partner)?

Yes, you can apply for early release of super to cover treatment for a dependent if the criteria are met and required evidence is provided.

How long does the application process take?

Processing times vary, but it can take several weeks, depending on how quickly you provide the required documents and the ATO’s assessment timeline.

Will accessing my super early affect my Centrelink payments or taxes?

Yes. Early release may impact your tax obligations and government benefits, including Centrelink payments.

What happens if my application is denied?

If you’re not approved, you may consider alternative options such as private health insurance or Dental Boutique’s payment plans.

Next Steps

At Dental Boutique, we’re dedicated to helping you achieve the smile you deserve.

If you’re exploring options like early super release, our team is here to guide you. Take advantage of our complimentary smile consultation—a 60-minute session with our experienced clinicians where you’ll receive a full smile assessment and a tailored treatment plan.

Your dream smile is closer than you think, and we’ll be with you every step of the way.

Disclaimer: This guide is for informational purposes only and is not intended to provide legal or financial advice or recommendations. Please consult a financial or superannuation professional or the ATO before making any decisions to withdraw from superannuation. The information provided is based on the ATO’s guidelines on early access to superannuation as published on its website as of 17 February 2025. For the most up-to-date and comprehensive details, please refer to https://www.ato.gov.au/individuals-and-families/super-for-individuals-and-families/super/withdrawing-and-using-your-super/early-access-to-super. Dental Boutique will not be liable for any errors, omissions, or inaccuracies in this guide.

50,000+ empowered smiles and counting